A lot of the potential changes we’ve explored recently make some intuitive sense to most people. Whether we are talking about rewards based on coinage versus per block, or the time between blocks, most of this we can kind of imagine their effect. However, one change that is proposed is a little bit more in depth, and I would love to spark some discussion about it because it is a pretty meaningful change to the way the statistics works. I am talking about the removal of the ‘ramp up’, which is the portion of the maturation period where coins start to gain mint probability but have not yet achieved full maturity.

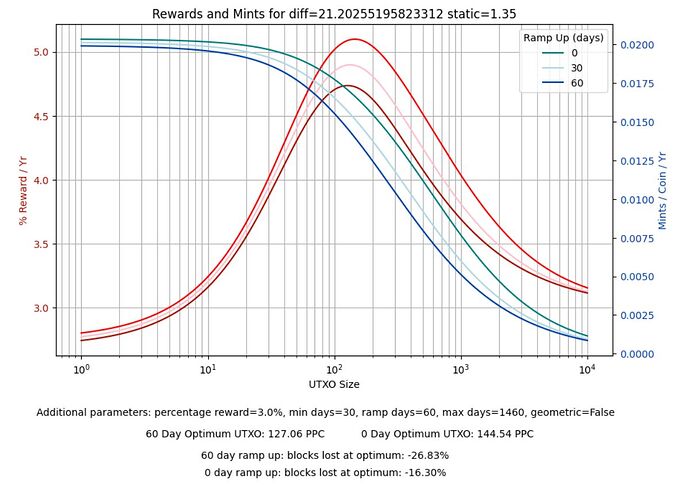

This graph shows 3 different cases, one with our current ramp up of 60, one with and in-between of 30, and one with 0. I want to point out a few things here, first is that the difference between 60>30 and 30>0 is pretty big. That’s because it’s basically a different form of statistics, once the ramp up is identically 0 the statistics can be solved fully by a geometric series. With any finite ramp up, you have to fully treat the day by day calculation. So it’s a pretty big functional change to the modeling, and one of the tantalizing reasons why we would want to implement it.

It should be fairly easy to see that the optimum remains in a pretty similar place, but the mint probability skews towards higher utxo sizes, meaning that the blocks lost at optimum goes down as we remove the ramp up period. This is another reason why we would want to remove the ramp up period. Indeed, this argument can be used against the maturation period in general, which would devolve toward a solution akin to what black coin ended up doing with ‘PoS 2.0’.

My counter argument here is that the maturation period is a crucial concept of building opportunity cost to offset the ‘nothing at stake’ argument. If a person can buy coin, crash the network, then sell the coin before the market can react, then that leaves the doors wide open to attack. We do have the post-mint period where the coinstake is locked from transacting, but that is a shorter 3 days or so. The maturation period of 90 days is a significant time investment for an attacker to make.

One degree of freedom we have here is that the maturation period consists of 2 parts: the ramp_up and the min_prob_days. We can, for example, remove the ramp up and double the length of the minimum wait period to mint. This would get the benefit of a simplified set of statistics while still preserving a good bit of the opportunity cost. The question mostly comes down to how we model this opportunity cost. Is an intelligent attacker who looks at our network more deterred by a 60 day wait period before they even get a chance to attack, or by a 30 day initial wait with a total of 90 days before they reach full potential? We can also consider the implications on user interface, does a new excited minter like the added complexity and slow engagement of the ramp up process, or is it confusing?

The removal of the ramp up with nothing to replace it is my biggest concern with the recent protocol modifications proposed. I would love to hear from some others in the community about your take on this subject.