Digital gold:

In this context gold is considered a “store of value”, as @Nagalim pointed out with somewhat naive words stating that store of value is something that has “stable or increasing price”. However there is no such thing in the world that guarantees stable or increasing price. It is just impossible, economy it is all about boom&bust cycles. At the moment gold is in the bubble and so we speak about it being store of value, so it is purely speculative and is subject to trend. In few years we will speak of something else.

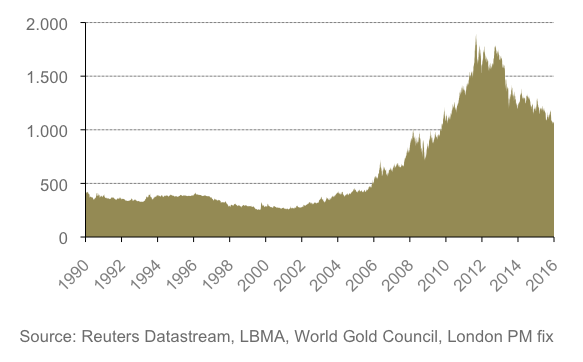

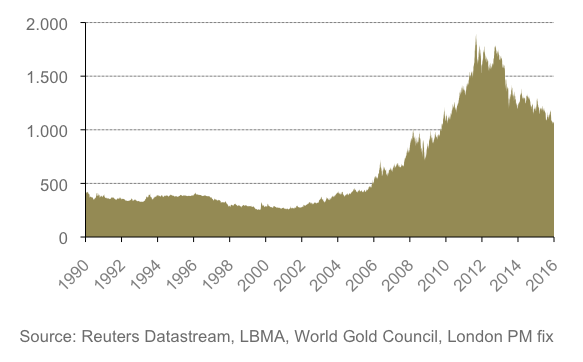

Check gold price in last 26 years:

Good old boom and bust.

IMHO gold is worthless beyond utility as technical metal, a building material. It is not exceptionally rare and it is just a matter of time before someone figures out how to dig out a lot more of it from deep underground. It is also mined daily, in small quantities though. Most of it’s value comes from notion that it is “rare” and inflation is quite low.

Digital gold, now that is a different story. Metal gold has to be mined, refined, transported, traded and then properly and securely stored (I wonder how much of a price comes from overhead costs of this process alone) so many people do not hold it at home but keep it at remote banks or so called “gold exchanges”. In this aspect it is not a good store of anything but financial risk as you have to trust so many 3rd party factors with your property. Metal gold can also be seized by govt while it is sitting in a vault somewhere.

In conclusion, gold is relatively rare and that is about it (it also has that historic charm).

So idea of digital gold is very appealing for masses, basically it should be just like gold (rare, low inflation) and something that you can send as easily as your nudies on Snapchat.

I would guess that in early days of Bitcoin, while small community of enthusiasts wondered on how to justify holding Bitcoin and getting new supporters invented this concept of “digital gold”, referring on Bitcoin’s capped supply. It is still common for people who are into cryptocurrency to think like this, that scarcity is what gives it value.

What they are saying is that Bitcoin (or similar clones) solve the problems with gold I’ve listed above while staying rare, and that is about it. (they do skip the fact that actual gold does not magically “halve” the inflation every 4 years, and does not have limited supply - supply is unknown.)

To conclude, Peercoin is superior to both gold and Bitcoin in this regard as it emulates the metal gold better than Bitcoin:

- it simulates the new supply of freshly mined gold via fixed 1% PoS inflation without abrupt changes in inflation

- it comes up with new coins continuously like gold which is mined for at least 10k years (this also makes up for lost coins)

- It is equally free of govt influence, but is also free of 3rd party miners which is equally important.

@supperppc has already touched this last point in greater detail:

[quote=superppc]

The reason why I think PPC is a great coin is because there is an alignment of interests, the interest of the holders. In bitcoin instead there are 2 interests, the one of the holders and the one of the miners. I think over time this problem will become bigger and bigger as the block reward drops. We can already observe the disconnect bitcoin is facing with segregated witness. Unlike sunny who believes that the issue will be the energy consumption I believe the issue would be the conflicting interests between miners and holders. In PPC we would probably have no issues implementing a change that is good for the holders. [/quote]

I also agree with superppc that relying on 3rd party (miners) for security is way bigger problem than energy consumption of PoW process. Peercoin has fixed that.

Conclusion is: Peercoin is good digital gold.

(but the hype of this concept is drying out as market matures, so we should move away from it)

Sustainable ledger for immutable settlements:

This is concept that became popular only after projects like various “colored coins” protocol and then Ethereum delivered more than a “coin” based on blockchain technology. This was only possible after people realized that blockchain delivered immutable, distributed database which also can make parties that otherwise would not trust each other to come to an agreement.

You can notice Bitcoin fanboys trying to fight this concept as it crashes their narrow world view bubble. (Just an example: https://twitter.com/peerchemist/status/814522872983068672)

What this concept tells us is that blockchain has more uses than something to relay “coins” from address to address, and thus it favors the blockchains where “coins” are used as fee to use the network’s blockchain. Do not confuse burning the coins with schemes where fee goes to block miner, burning the fee is relevant in this concept - nothing else.

In this regard Peercoin is totally same as any other blockchain where fee is burned, with one key difference - sustainability.

Peercoin is extraordinary cheap to keep operational, and security of the network does not depend on the market capitalization.

So: immutable, secure and sustainable public ledger.

Looking forward to hear more thoughts on this subject.