Paul Krugman took a swing at cryptocurrencies. wisdom or bullshit? Will the economy regress when fiat money is replaced by cryptocurrencies? As a fan of Hayek, I believe that gov’t should not have the monopoly over currency and that cryptocurrencies will lead a rise against this monopoly.

With higher confirmation speed and elastic supply, could primecoin take root in daily trades?

I am not an economist, so I can not give any suggestion. But I can show you Sunny King’s ideas about this question.

I copied this from Sunny King Interviewed by Crypto Capitalism Center - July 06, 2016

Sunny King: as you can see, i am more focused on the tech side of things

Sunny King: though I am kinda interested to hear from you people on social economic side

Ying-Ying: I can send you a copy of my research draft once it’s done… : )

Ying-Ying: So why did you choose to remain anonymous? : )

Sunny King: in my view the bitcoin technology is kinda like gold

Sunny King: a form of digital gold

Sunny King: though there is some significant difference

Sunny King: it has better monetary property than gold in some aspects

Sunny King: but it also lacks the domination of gold, that is, gold has actually no competition in the physical world (commodity)

Sunny King: so bitcoin will be subject to tech competitions, unlike gold

Ying-Ying: exactly.

Sunny King: but still, i believe the experiment has already shown that it is indeed a new form of money

Ying-Ying: In addition, the fact that it is not physically tangible could mean something cognitively different to people.

Ying-Ying: More like money than gold then?

Sunny King: the reason some of us chose to be semi anonymous, of course ,

Sunny King: of course the idea is controversial in that

Sunny King: governments of the world have been on fiat for over a century now

Sunny King: maybe they wouldn’t be quite open to the idea that gold, in a different reincarnation

Ying-Ying: they are certainly still trying to make sense of it!

Ying-Ying: How does anonymity of developers affect the perceived trustworthiness? (or does it have any other effects at all?)

Sunny King: but so far the development in the past few years, i am also optimistic

Sunny King: i think people have been quite open to the new ideas

Even saints make mistakes. Don’t think Krugman is right on bitcoin.

Imagine to base your whole academic career on a school of thought whose core tells you to achieve full control of money printing and artificial demand in order to keep your economy growing, whatever it takes.

Then comes the cryptocurrencies and basically shit on top of this whole theory.

He is right to be mad. He’s desperately trying to defend his point.

Stablishment economists gonna stablish. Let them talk.

Also, relevant whenever a keynesian economist is on the topic:

@kazzkiq I am no expert on economics, but don’t you think Peercoin would be more favorable to Keynesian economists rather than those from the Austrian school?

The inflation rate of Peercoin for example is around 1-3% every year. How does that compare with the inflation rate of fiat currencies controlled by central banks? It seems to me that if Peercoin became a standard in the future, people could not just hold their wealth in Peercoin (with the exception of minters). It would still have some amount of yearly inflation, forcing people to invest in other things in order to avoid that few percent value loss.

It is a similar argument I’ve heard where central banks target a certain percentage inflation in order to add some small amount of motivation to get people to continually reinvest their money into the economy instead of allowing it to sit around in savings. Bitcoin on the other hand is setup for deflation because of the consistent halvings and I imagine it will just cause people to want to hoard the currency over time instead of spend it.

The inflation rate in Peercoin is not too large to cause significant yearly value loss to savers, but it’s enough to cause certain people to want to find a more productive vehicle for their money. Those who mint will also be able to avoid that loss completely. This is of course referring to a time in the future where the price is not fluctuating so wildly.

I was just wondering what you thought about this topic. It just seems to me that Peercoin is geared more toward mainstream economists, but maybe I am wrong.

Hmm, it seems that Sunny King also does not favor gov’t on mint.

hahah, it is too hard for these economists to reconcile with the fact.

Hmm so you think cryptocurrencies will replace fiat?

For me, hardly any original cryptocurrency project is geared toward mainstream economics.

The inflation rate of Peercoin for example is around 1-3% every year. How does that compare with the inflation rate of fiat currencies controlled by central banks?

In theory, keynesian-influenced countries would use their print machinery solely on imperative situations such as recession or upon economy stagnation as a way to stimulate it again. In practice this theory becomes a green card for indiscriminate creation of money, without clear rules and backed by nothing but thin air and good intentions. You can’t foresee what or how much will be printed, which diplomatic actions of your government will wreck your currency even further, and thus you can’t control the loss of value the money in your pocket will face. Pretty far away to what any decent cryptocurrency aims to.

Peercoin basically has two ways of “printing” new coins:

- Through PoW mining;

- Through minting in PoS;

Peercoin’s PoW has a mechanism that I consider more elaborated than Bitcoin in this regard: The higher the difficulty in the mining process, the lower the reward (number of coins minted) per block. This serves two purposes IMO: to help control mining power, and to help control coin supply. An action that, as I see, works against inflation while not being totally die-hard by fixing the total supply like Bitcoin. Peercoin approach works more realistically by letting the supply float indefinitely, but with clear rules, which isn’t even close to what we see in mainstream economics today.

Transaction fees are also burned in Peercoin. This too serve two purposes: To keep miners in check (giving less incentive for toxic actions for more “taxes profit” as seen in Bitcoin today) and to lower coin supply. Which also looks like a tool to fight against inflation for me.

So Peercoin have a realistic approach on not fixing its max supply, but also not letting it get out of hand causing undesirable amounts of inflation. This is all defined in a code that’s basically immutable (unless a serious hard-fork occurs) with clear rules and on a transparent protocol. Not sure if this relates at all with the approaches we see today in use by keynesian-based economies.

Another important difference I think is the argument Austrians make about the boom/bust cycles that disrupt the economy and how they’re created. The way I understand it is that central banks inject the newly printed money into banks around the country.

A bank’s interest rate for loaning is usually a high percentage if not many people are saving and there is little money in the reserve. If however many people are saving and there is a lot of money in the reserve because of this, the interest rate for loaning is reduced to reflect this fact. The interest rate is an important economic indicator for businesses to pay attention to because it tells them when the majority of people have extra savings in the bank that they can spend. If the interest rate is low for example that is supposed to mean lots of people around the country have extra savings in the bank, so that tells the business owner that it’s a perfect time to invest in a long-term project or to release a product.

Central banks however disrupt this important economic signal. When they inject new money into banks, it adds more reserves which artificially lowers the interest rate. Businesses think because the interest rate is low that there are plenty of people with savings (when in reality savings are low). Because of this, they end up misjudging the economic landscape and borrow money for long-term projects that are unsustainable in reality because there are not enough people with savings to spend money. It ends up creating a timing mismatch in which a business owner invests money in a long-term project when they really should have waited until a time when people have more money to spend.

I think there may be more to this theory, but I have not studied it in-depth. The point though is that newly created cryptocurency is not injected into banks. It is instead sold on the market. So cryptocurrencies avoid triggering the boom/bust cycle since they do not play a part in artificially lowering banking interest rates for loaning. This can be applied to any cryptocurrency though, not just Peercoin.

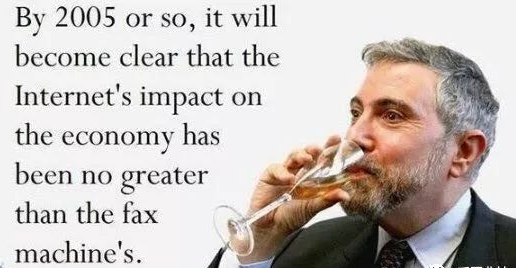

Absolutely despise Krugman and his views. Read through anything he has predicted before. Guy is only famous because he has a monopoly on econ books that get put in the hands of young kids as they grow up.

See his views on the internet: Paul Krugman’s poor prediction. | Lapham’s Quarterly

Would suggest googling “Krugman wrong”

Well, for Krugman, he has been saying exactly the same thing since 2013, when Bitcoin was like, less than $1000? Wish none of you listened to him.

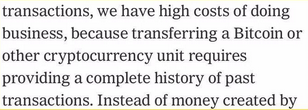

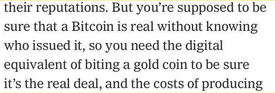

I’ll simply give some of his orginal sentences and you’ll see how ridiculous his reasoning is:

and

and also,

(this was 1998)

He’s standard reading for american high schools and universities. Dominates all educational literature.