max reorg depth certainly limits this with the year long average though, so the private chain strategy may be less concerning than i am imagining.

absolutely right, I don’t think it’s viable especially considering maximum of 2 weeks for coinstake selection interval and greatly reduced trust of that chain making the whole endeavor simply impossible.

i would prefer to have a value that would incentivise the minters to keep coins in the wallet.

The other concern is that if this year there are less coins minting than last year, then the adjustment will be decreasing. If you assume that this trend continues, it behooves you to hold your coins for a few months before minting to wait for the adjustment to decrease. If we set a minimum of 10%, that gives a lot more play for this kind of move than if we set it at 20%. This is a reference to the concern ortiz had originally.

so instead of earning compound interest you watch stakemap reduce to the minimum and only mint once max adjustment has been reached? wouldn’t that require coordination between minters? will leaving maximum at 5.0 as originally planned would change anything with regards to this dynamic?

No coordination, just a gamble. First of all, you can just be watching a top-level graph of the adjustment modifier, which we will likely provide once this deploys. You see it’s going up and you hold off. This is a gamble, as it could turn around again at any moment. While you do so, you are losing compounding interest and have no guarantee of success, but sometimes your gamble might pay off. This is essentially like watching a stock go up and waiting to sell, even though you have opportunity cost elsewhere ticking away. It might not be the smartest choice, but because it pays off sometimes people might choose to do it.

Having a maximum provides a limit to how far you can take this, a ceiling. With a modifier of 5, we are saying ‘if the participation is below 20%, no more games just mint’. With a modifier of 10, we are hoping that the increased compounding interest makes it not worth it to wait for that extra kick of 0.5%/year when the participation has dropped from 13% to 11%.

In my opinion, there is an abstract balance point here. It is difficult to objectively choose this number, but I tend to think that we want to use it to declare a kind of minimum participation we are comfortable with on the worst days. However, you are right that we also want to make sure the reward we are offering is enough to incentivize. My initial thought is that 5%/year is pretty attractive to an investor, and 20% participation is pretty good for the chain historically.

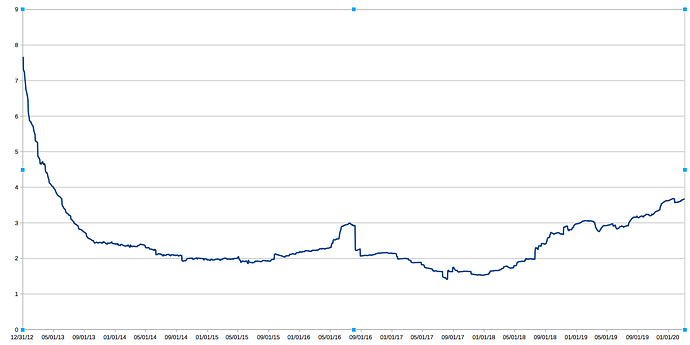

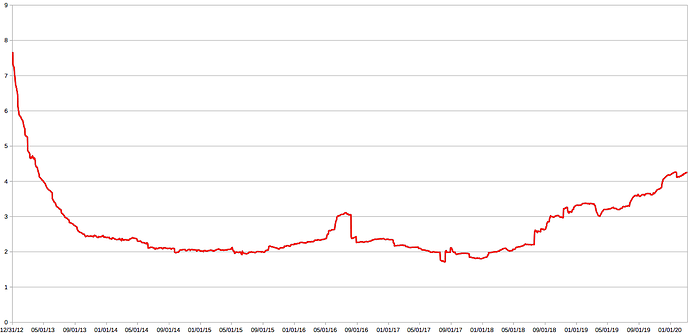

watch me create a graph of unbound inflation modifier for mainnet

So 5 would be a historically good number. The difference is a PR trade for what I see as a security measure.

it seems that this chart reflects older version of rfc11, where there was no cap on maximum coinage. here’s updated graph for main net

I’d like to reiterate for anyone reading that the maximum coinage is a new restriction that reduces the reward for an output that is older than 1 year. While people have talked a lot about the increase in reward from the inflation adjustment, I’m not sure people have paid as much attention to this reduction in reward. For those that are continuous staking, the reduction is likely minimal. However, for those that stake only once a year or even wait multiple years to stake, this reduction will result in a sizable decrease in reward. In the short term, this reduction is likely trivial for all users compared to the increase offered by the adjustment. However, if we begin to attain mint participation over 50%, users that wait 2 years between minting will actually see an overall reduction in stake rewards after rfc11. This provides some motivation for continuous minting and also prevents someone from waiting years for a favorable adjustment before participating.

rc3 is out containing all discussed functionality, so now we need to test it sufficiently on the testnet at least.

Does this have any effect on small continuous minters that take over a year to mint a block due to their tiny stake?

Yes, of course. If someone is continuous minting with 0.01 ppc and it takes them 10 years to mint, then they will lose reward under rfc11. At current network conditions, any outputs that mint within a 4 year period end up with a higher reward under rfc11. There has always been a practical minimum to minting of around 100 ppc, and that is still the case here. The change is that before you would only lose compounding interest for minting with a tiny amount of ppc, now you will lose principal interest.

That is one drawback I guess, however it can be solved through pooled minting.

I don’t think it can. I’m not sure what you mean by ‘pooled minting’ in this context. RFC12 allows you to have others mint for you, but it does not allow you to add your outputs to other outputs to increase chance of block creation.

I just mean that people with small stake should be able to join a minting pool correct? That would turn a small stake into a larger one (with the help of funds from others), which prevents them from having to wait more than 1 year to earn a reward. Or am I missing something?

That’s not how mint pools work under any current proposal. The outputs are not added together, it’s just that there are special ‘mint keys’ that can mint an output separate from spending keys.

We could discuss possible solutions involving minting multiple outputs into a single coinstake. I’m not sure how hard/easy that is. Combined with rfc12, it could potentially do what you are trying to do.

I’m not sure how the hashing would work for multiple coinstake utxo’s. This might be a rather hard problem to solve to get the result you are hoping for.

I don’t consider it an immediate problem, since coins are cheap right now and it’s easy to buy enough stake to mint blocks within the 1 year timeframe.

However longer term if it becomes more expensive to build enough stake to easily mint within one years time, we should have something available that can help these people participate, lest we open ourselves up to accusations of being unfair and favoring those with larger stakes.

Another possibility here is to reduce the frequency of splitting outputs from anything minting under 90 days to anything minting under 60 days. It’s a stochastic thing, so it’s hard to pinpoint the best number, but the difference between 90x2=180 and 60x2=120 when considering a 365 day max is pretty big in my opinion.