This thread demonstrates and discusses a simple toy index.

Currently the constituent assets in the basket are bitcoin (BTC), peercoin (PPC), and ripple (XRP). Choosing BTC is because it is by far the most prominent and liquid crypto. PPC is there because it is the first Proof-of-Stake coin free from misalignment of miner interest and coin owner interest. PPC uses Proof-of-Work mining to solve the initial distribution problem many POS coins suffer, and is traded on many exchanges, XRP has a relatively long history, healthy liquidity and, being a non-currency and somewhat centralized, less correlation with BTC.

Test examples of the index were discussed before. Basically the algorithm evaluates volativity of every underlying asset, and assigns weight of every asset accordingly. The result is an index that catches the overall growth but inhibits volatility.

Traditionally funds that reflect broad market growth choose a sample of representative stocks, and assign the weight of each basket constituent (stock) according to its market cap. A benefit of market cap weighted basket is that the number of unit of an asset in the basket does not change if the unit price of the asset changes, because both market cap and basket weight are proportional to asset price. This makes managing of such fund relatively easy and inexpensive.

Using crypto marketcap to choose basket constituents or basket ratios of a crypto fund is not a good idea, however, Due to a lack of regulation (by technical mechanisms or by government oversight) crypto marketcaps can be easily manipulated.

The test baskets for Indicium choose constituents based on age since blockchain start (> 1 year) and liquidity (top 30 on coinmarketcap). The founders and board members will choose the style and basket constituents of product funds of Indicium. However for the Minimal Variance Fund, a consequence of algorithm-based dynamic weighting is that one can stick his favroite coin in the basket, but the algorithm can assign a nearly zero weight to it, partly negating human meddling.

Another consequence of dynamic weighting is that the weight of all constituents may need to be adjusted (“rebalanced”) often to follow the algorithm, increasing work and exchange fees. The balance between fee cost and tracking deviation needs to be found from simulation and testing.

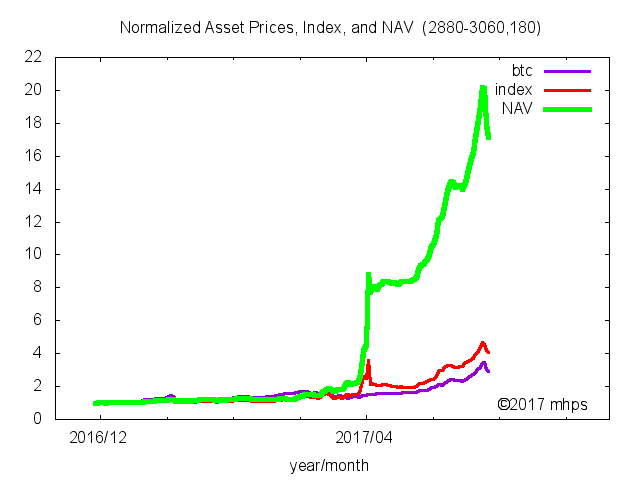

Although the basket discussed in this thread is very small and simple, its quite effective. The following chart shows the Net Asset Value (NAV) of this fund in the last 6 months if the initial investment is 1 (any unit)

The fund value increased to 17 times (green curve). If you had held bitcoins only, you would get 2.9 times (blue curve), and peercoins, 6.2 times. You would get a whooping 42 times gain with Ripple. But remember you have to be smart and determined enough to have had known months before xrp price rose and hold nothing but Ripple to be able to catch the surge. That would be very difficult. Why not ETH? Why not another exploding coin?

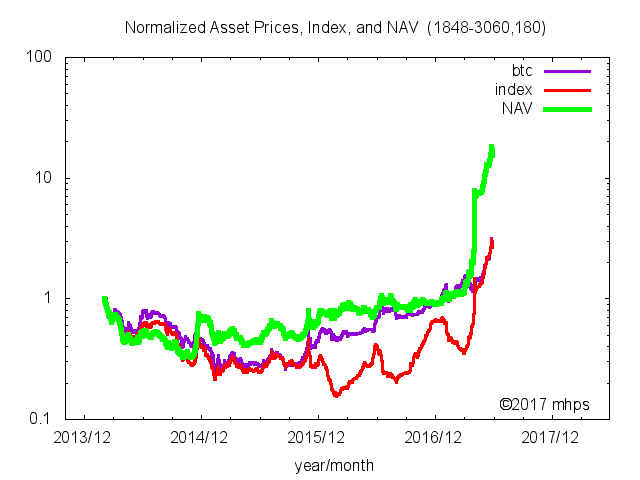

This index can go back to early 2014. The figure below is a logarithmic scale plot of the NAV for the last 3 years. NAV gain is 15.5 times, outperforming bitcoin by 69.5% per year (in term of Compound Annual Growth Rate, CAGR).

The main feature to take note is that the curve started when the 2013-14 bubble was bursting. Whle bitcoin was going down the NAV curve held flat initally and started trending up in 2015, showing lower volatility.

If you are interested, you can try a investment simulation of $100 by buying these

0.040 btc, 7.1 ppc, 7.8 xrp

The ratios are determined using prices at about 1:20 UTC on May 27, 2017 ($2202 btc, $1.56 ppc, $0.27 xrp). The fact that bitcoin price was crashing doesn’t matter much.

Apparently the fund mostly holds btc at the moment, because ppc has been actually having greater volatility recently. Ripple contributes only about 1% NAV due to its high volatility after explosive growth.

Disclaimer: This is not an investment suggestion. Past performance is not an indicator of future outcomes.